Self-Assessment Tax Payment Deadline: Everything You Need to Know Before 31 January 2025

Chrissy Leach • 20 January 2025

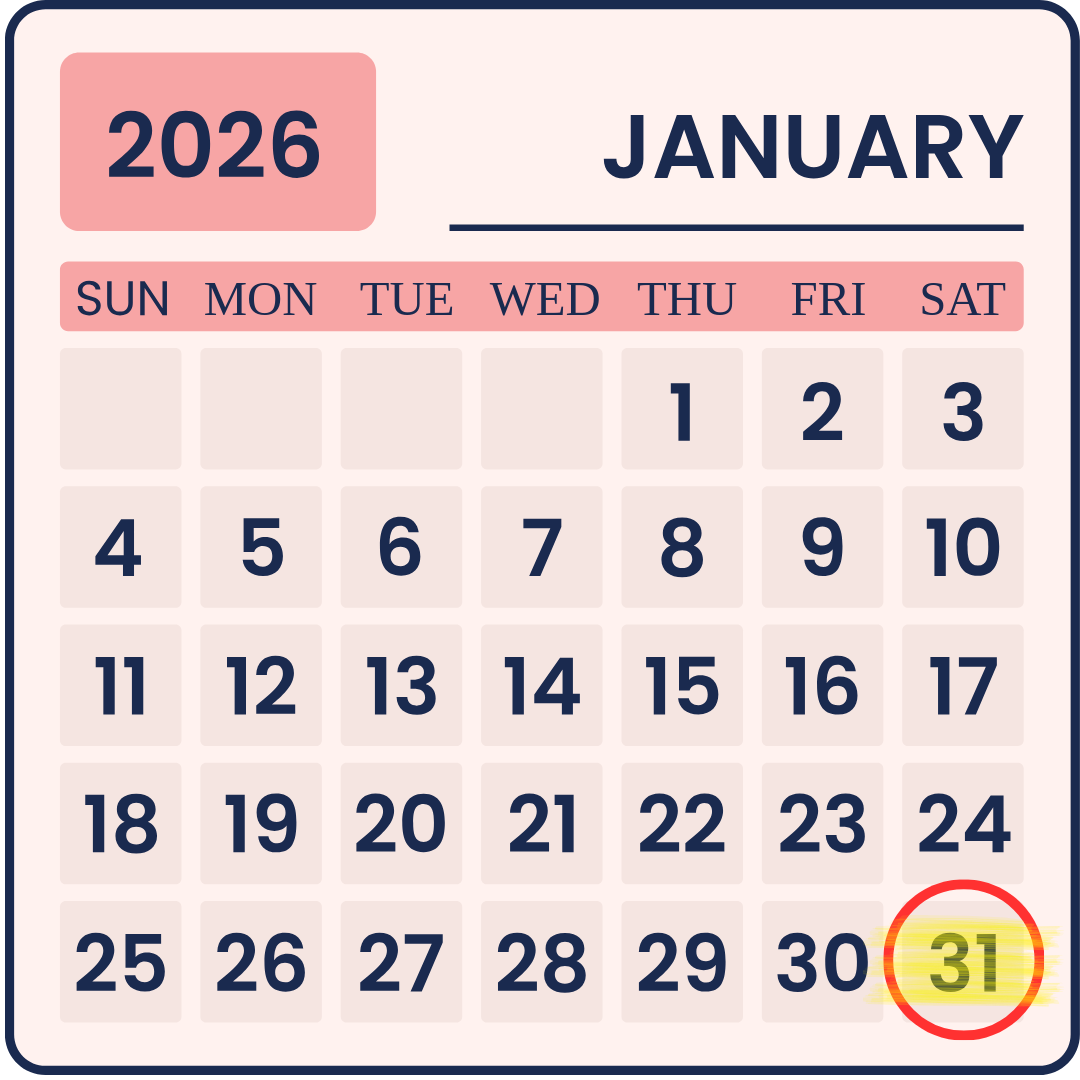

Don’t forget that the tax payment deadline for the 2023/24 tax year is 31 January 2025!

Whether your tax return has been filed already or not, if you have a tax liability for the 2023/24 tax year, the payment is due by 31 January 2025.

If you pay payments on account, your first payment for the 2024/25 tax year will also be due by 31 January 2025. This is relevant if your 2023/24 tax liability was over £1,000 and you don’t have 80% of your tax paid via payroll.

What Happens if You Miss the Deadline?

If you miss the 31 January 2025 deadline, it can be costly.

HMRC will charge interest (the current rate is 7.25%) until the liability is paid.

If you have any tax still owing after 30 days (2 March 2025) then there is also a penalty charged at 5% of the tax due.

Another 5% penalty is charged after 6 months and another 5% after 12 months for any tax still owing.

What Should I Do?

We would recommend logging into your self-assessment account to check whether your tax return is filed and if you owe any tax.

If you don’t have a self-assessment account set up yet, you can create one on the HMRC website.

If you have an accountant, they’re likely to have contacted you if you have a payment to make but you can also check with them.

What If I Can’t Afford My Tax?

If you have tax to pay but can’t afford it then it’s worth setting up a Time to pay agreement with HMRC as soon as possible, ideally before the payment deadline. You can do this by searching HMRC time to pay on the internet (make sure you’re on the official gov.uk website).

This suspends the late payment penalties as long as you keep up with the agreed payments. Interest will still be payable.

Why Work with CJL Accountancy?

Tax can be complex, especially if you’re juggling multiple income streams or navigating HMRC’s ever-changing rules. At CJL Accountancy, we specialise in helping influencers, landlords, and small businesses maximise their tax efficiency.

We encourage early tax return preparation and in year calculations where relevant so that you have time to plan for your tax payments.

We will advise on the costs you can claim to ensure that you don’t pay more tax than necessary.

Act Now: Don’t Wait Until the Last Minute

With less than two weeks to go, make sure you know if you have a tax payment to make.

Let CJL Accountancy take the stress out of your tax return. We’re not guaranteeing 2023/24 tax returns at this late stage but contact us if you’d like help with your 2024/25 tax return. Getting an accountant in place early will mean there’s plenty of planning time to maximise allowances, reduce your tax and plan for payments.

Growing a business is exciting, but without a solid financial plan, growth can quickly turn into strain. A clear, realistic budget helps you stay in control of cash flow, make confident decisions, and ensure your business can scale sustainably. Below is an easy‑to‑follow guide created for UK small business owners looking to budget smarter. Why Budgeting Matters for Business Growth Budgeting isn’t about restricting your business, it’s about enabling growth. A good budget allows you to: Allocate resources strategically Identify affordability before committing to new costs Spot cash flow gaps early Plan for investment and expansion Make informed decisions backed by data In short: budgeting gives you control, not constraints. 1. Start With Your Current Financial Position Before planning ahead, understand where your business stands today. Review: Profit and loss trends - look at (at least) 12 months of revenue, gross profit, overheads and net profit. Cash flow patterns - seasonal sales, slow-paying customers, or VAT deadlines can all affect available cash. Key cost drivers - staff costs, materials, and marketing expenses are common areas of change as you grow. This foundation helps you create realistic future projections, not optimistic guesses. 2. Forecast Your Revenue Accurately Growth begins with understanding where increased income will come from. Break revenue forecasts down into: Products or services Customer types Sales channels Price changes Then consider factors like: Market trends Capacity to deliver Planned investments (e.g., new staff or equipment) Economic conditions Lead times for new sales Tip: Use three scenarios - best case, expected case, and cautious case. This ensures you’re prepared for ups and downs. 3. Plan Your Costs - Both Fixed and Variable As businesses grow, costs can rise quickly and unexpectedly. Budgeting for them avoids cash flow surprises. Fixed costs include: Rent Insurance Software subscriptions Loan repayments Variable costs include: Materials Freelancers/contractors Sales commissions Packaging/delivery costs Growth‑related costs to plan for: Hiring staff Increasing stock Upgrading equipment or software Additional marketing spend Professional fees Forecast these carefully so you know exactly what you can afford. 4. Don’t Forget Tax Obligations Many businesses forget to budget for taxes, then panic when the bill arrives. Key ones to factor in: Corporation Tax (19–25% depending on profits) VAT (if registered) - also keep an eye on revenue and the VAT threshold if you're not registered yet PAYE and NICs for staff - including any additional hires Setting money aside monthly avoids unwanted surprises. 5. Monitor and Adjust Your Budget Monthly Your budget shouldn’t sit in a drawer. Review it monthly so you can: Compare budget vs. actuals Identify overspending early Adjust spend based on revenue Respond to market changes Reallocate resources to what’s working Consistent reviews make your budget a living, breathing growth tool, not a static document. 6. Plan for Cash Flow, Not Just Profit A profitable business can still run out of cash. Growth often causes cash pressure due to: Higher stock levels Bigger payroll Longer customer payment terms Upfront investment in marketing or equipment Use a rolling 12‑month cash flow forecast to track: When money is due in When payments go out Peaks and troughs in available funds Cash flow visibility is key for confident growth. 7. Build a Growth Fund or “Opportunity Pot” Set aside a percentage of profits each month into a dedicated pot for: Expansion New product development Extra staff Technology upgrades Marketing pushes This avoids borrowing every time you want to take the business to the next level. 8. Use Technology to Stay in Control Modern accounting software makes budgeting much easier. Tools like Xero, Sage, Quickbooks allow you to: Generate forecasts Track actuals vs budget Monitor cash flow Spot trends instantly 9. Get Professional Support When Planning for Growth As your business expands, financial decisions become more complex. Working with a Chartered Accountant can help you: Set realistic budgets Forecast cash flow Identify tax‑efficient strategies Understand the numbers clearly Make confident, informed decisions Growth is simpler when you have expert guidance. Final Thoughts A well-planned budget is one of the most valuable tools for business growth. It helps you stay in control, plan ahead, and make smart financial decisions with confidence. With the right structure, forecasting, and regular reviews, your budget becomes more than numbers, it becomes your roadmap to sustainable, profitable growth. Need Help Managing Your Growth? CJL Accountancy can help you set up better systems, understand your numbers, and make informed financial decisions. 📞 Get in touch today to book a free consultation.

Why Cash Flow Matters More Than Profit Many small businesses focus on profit, but it’s cash flow that keeps your business alive day to day. Even profitable businesses can run into trouble if they don’t have enough cash to cover expenses like rent, payroll or supplier invoices. Cash flow management is about understanding where your money is coming from, where it’s going, and when. Managing it well helps you plan ahead, reduce surprises, and make confident business decisions. 1. Forecast Your Cash Flow A cash flow forecast is one of the most powerful tools for business owners. It gives you visibility over your expected income and outgoings for the next few months so you can see potential shortfalls early. You don’t need anything complicated: a simple spreadsheet or software like Xero can help you track and project your cash position. Tip: Review your forecast monthly (or weekly during busy periods) and update it as new information comes in. 2. Get Paid Faster Late payments are one of the biggest threats to healthy cash flow. Invoice quickly - don’t wait until month-end. Use online payments - make it easy for clients to pay instantly. Set clear payment terms - include due dates and late payment penalties. Send friendly reminders - automated email nudges work wonders. If you’re a limited company, linking your accounting software to your invoicing system (for example, Xero + Stripe or GoCardless) can speed things up dramatically. 3. Control Your Outgoings Keeping track of expenses can be tricky when you’re busy, but it’s essential for good cash flow management. Review subscriptions and software costs regularly - cancel what you don’t use. Negotiate better payment terms with suppliers. Delay large purchases until you know your cash position is strong. Separate business and personal spending to keep things clear for tax and accounting. 4. Build a Cash Buffer Unexpected costs happen - a client pays late, a big bill lands, or business slows down. Having a cash reserve can keep your business steady during lean months. Aim to save at least one to three months’ worth of expenses. Set up a separate savings account and transfer a small percentage of every invoice you receive. 5. Use Cloud Accounting Tools Digital tools like Xero, QuickBooks, and FreeAgent make cash flow management easier than ever. They connect directly to your bank, automate reconciliations, and show your real-time cash position at a glance. 6. Keep on Top of Taxes VAT, PAYE, and Corporation Tax can take a big bite out of your cash flow if you don’t plan for them. Set money aside regularly for tax, ideally in a separate account. Your accountant can help estimate what you’ll owe each quarter so you’re never caught off guard. 7. Get Professional Advice Early If your cash flow is tight, don’t wait until it becomes a crisis. A good accountant can help you: Review your financial position Create realistic forecasts Identify areas for improvement Plan ahead for tax and growth At CJL Accountancy, we work closely with business owners to strengthen their finances, simplify bookkeeping, and keep cash flowing smoothly. Final Thoughts Cash flow management isn’t just about survival, it’s about creating stability and freedom in your business. With clear visibility, smart tools, and the right support, you can take control of your finances and plan for long-term success. Need Help Managing Your Cash Flow? CJL Accountancy can help you set up better systems, understand your numbers, and make informed financial decisions. 📞 Get in touch today to book a free consultation.

In 2026, technology has transformed the way businesses handle their finances. With smart accounting software, automated bank feeds, and AI-driven reporting, you might be wondering: Do I even need a bookkeeper anymore? We may be biased but we think the answer is yes. Focus on Growing Your Business Every business owner knows that time is money. The hours spent reconciling accounts, chasing receipts, or categorising expenses could be better invested in strategies that grow your business. A professional bookkeeper frees up your time so you can focus on sales, marketing, product development, and client relationships, the areas that directly impact your revenue. Expertise That Makes a Difference Even with the most advanced accounting software, human expertise is irreplaceable. It often just looks for outstanding costs for the same amount, not taking into account who the payment is to. A skilled bookkeeper understands not just how to record transactions, but why they matter for your business. They ensure your accounts are accurate, your tax obligations are met, and your financial reports give you meaningful insights. This expertise helps you make informed decisions, spot opportunities, and avoid costly mistakes. Stay Compliant with Confidence Financial compliance is more complex than ever. From VAT obligations to Self Assessment, missing deadlines or misreporting can lead to penalties and stress. A bookkeeper keeps you on track, helping you stay compliant without having to become a finance expert yourself. Boost Your Business Intelligence Bookkeepers and accountants do more than just balance the books. They provide insights into cash flow trends, profitability, and cost-saving opportunities. With accurate, up-to-date financial data, you can make confident strategic decisions, plan for growth, and spot potential challenges before they become problems. Conclusion In 2026, the role of a bookkeeper isn’t just about data entry. It’s about giving business owners the freedom to grow while having an expert handle the complexities of finance. If you want more time, more confidence, and better insights into your business finances, a professional bookkeeper remains an invaluable investment. At CJL Accountancy, we can help with all of your finance needs from year end accounts and tax returns, to a full virtual finance office including bookkeeping, paying suppliers, chasing customers, payroll and VAT. 📞 Get in touch today for friendly, professional support with your finances.

From April 2026, thousands of sole traders and landlords will join the next stage of Making Tax Digital (MTD) and it's not something that can be ignored. What is Making Tax Digital? Making Tax Digital (MTD) is an HMRC initiative designed to make the UK tax system more efficient, accurate and easier for taxpayers to manage. It replaces traditional paper-based records and manual submissions with a digital-first approach. MTD affects how businesses and individuals keep their financial records and how they submit tax information to HMRC. You will need to keep your transactions digitally and send quarterly updates to HMRC. Who Does MTD Apply To? From April 2026, self-employed individuals and landlords with annual income over £50,000 in their 2024/25 tax return will be in MTD. This is gross income before deducting any expenses, and if you have multiple self-employments or let properties, or both, then it's everything added together. You can ignore other income like employment or pensions. What Are The Deadlines? The quarterly submissions will depend on whether you do your accounts to 31 March or 5 April, but the deadline is the same for both. It will either be: 6 April 2026 to 5 July 2026 – due by 7 August 2026 6 July 2026 to 5 October 2026 – due by 7 November 2026 6 October 2026 to 5 January 2027 – due by 7 February 2027 6 January 2027 to 5 April 2027 – due by 7 May 2027 Or: 1 April 2026 to 30 June 2026 – due by 7 August 2026 1 July 2026 to 30 September 2026 – due by 7 November 2026 1 October 2026 to 31 December 2026 – due by 7 February 2027 1 January 2027 to 31 March 2027 – due by 7 May 2027 Here’s how to start preparing in a way that saves time, reduces stress, and keeps you compliant. 1️⃣ Open a dedicated business bank account If you haven’t already, now is the time to separate your business and personal finances. MTD will be much easier if your records are clear, accurate, and easy to connect with your accounting software. Having a dedicated business bank account means: You can automatically import transactions into your accounting software Your income and expenses are easier to track and categorise You’ll reduce errors, and the temptation to mix personal and business spending Many modern business accounts are free and MTD-friendly. 2️⃣ Choose your MTD-compatible software To comply with MTD, you’ll need to record income and expenses digitally, and send quarterly updates to HMRC. You can use a spreadsheet but you'll need dedicated bridging software to do the quarterly updates so we would recommend using bookkeeping software as there are other benefits, and there are some free options. ✅ Sage Individual Free is an option for self-employed users and landlords with simple accounts. ✅ Mettle (by NatWest) is a free bank account and, as long as you make one transaction per month, gives you free access to bookkeeping softaware FreeAgent. There are other low cost options available, speak to your accountant if you're not sure. Whichever you choose, make sure it can: Record transactions digitally Categorise income and expenses Submit quarterly updates automatically Prepare the annual “End of Period Statement” (EOPS) and final declaration Bookkeeping software can give you a clearer picture on your profits and what your tax liability is going to be, so you can be more prepared. 3️⃣ Get into the habit now Even though you don’t need to file under MTD until July 2026, it’s smart to start working digitally now. You’ll get used to: Keeping records digitally Reviewing your profit and loss regularly Planning for tax instead of being surprised at year-end 4️⃣ Plan ahead for the April 2027 expansion From April 2027, MTD will extend to those earning over £30,000 from self-employment and/or property. So, even if you’re not caught in 2026, it’s still worth getting your systems ready now. The same software, habits, and bank setup will apply, so anything you do today puts you ahead of the curve. How CJL Accountancy can help At CJL Accountancy, we’re already helping clients transition to digital record-keeping smoothly. Whether you need advice on which software to choose, or want a walkthrough of quarterly reporting, we can guide you every step of the way. We can even do your digital bookkeeping and submissions for you. 📞 Get in touch today to start your digital tax journey with expert support every step of the way.

What is a Time to Pay Arrangement? A Time to Pay arrangement is a payment plan agreed with HMRC that allows you to spread the cost of your tax bill over a longer period if you can't afford to make the payment on time. Rather than facing penalties or enforcement action, you can work with HMRC to pay your tax in manageable monthly instalments. Who Can Apply? You can request a Time to Pay arrangement if you: Owe tax to HMRC and cannot pay it in full on time Are willing to pay what you owe in instalments Communicate proactively with HMRC before or shortly after the payment deadline How to Apply for a Time to Pay Arrangement 1. Check if you’re eligible online If your Self Assessment tax bill is under £30,000 and you: Have no other payment plans or debts with HMRC Are within 60 days of the payment deadline Have filed all returns up to date You can usually set up a Time to Pay plan online through your HMRC account - no need to call. 2. Contact HMRC directly For larger debts, or if you don’t meet the online criteria, you’ll need to call HMRC’s Payment Support Service. They’ll ask for details such as: The amount you owe Why you’re struggling to pay What payments you can afford each month 3. Agree a payment plan If HMRC agrees, you’ll receive confirmation of your monthly payment amount and duration of the plan. Payments are typically made via Direct Debit. What HMRC Will Consider When reviewing your request, HMRC will look at: Your financial position and cashflow forecast Whether you’ve kept up with past tax obligations Your ability to make regular payments They’ll want reassurance that the debt can be cleared within a reasonable timeframe. What Happens If You Miss a Payment? If you miss a payment or don’t keep up to date with new tax obligations, HMRC can cancel the arrangement and demand the full amount immediately. It’s crucial to contact HMRC straight away if your circumstances change - they may be able to adjust your plan. Benefits of a Time to Pay Arrangement ✅ Avoids penalties and enforcement action ✅ Protects your credit and reputation ✅ Helps manage cashflow during tough periods ✅ Keeps your business trading while catching up on tax Need help simplifying your taxes? At CJL Accountancy, we can help you understand your tax, make sure your Self Assessment is accurate and up to date, and advise on how best to approach HMRC if you’re struggling to pay. 📞 Get in touch today for friendly, professional support with your Self Assessment.

If you’re self-employed and use a car for business purposes, knowing how to claim your vehicle costs correctly can save you both time and money. HMRC offers two methods for claiming car expenses: actual costs and simplified expenses. Choosing the right method depends on your circumstances and record-keeping preferences. What is Business Mileage? Business mileage refers to your journeys for work-related activities that are not your normal commute. This includes: Visiting clients or suppliers Traveling between work sites Collecting or delivering goods Attending business meetings or events Commuting from home to your usual workplace does not count as business mileage. Keeping an accurate mileage log is essential for claiming either actual costs or simplified expenses. Actual Costs: Claim What You Really Spend Claiming actual costs means calculating your business-related vehicle expenses based on your receipts and records. Eligible costs include: Fuel Insurance Road tax MOTs Repairs and servicing Vehicle cost (subject to capital allowance rules) How it works: You need to calculate the percentage of business use. For example, if your car is used 60% for business, you can claim 60% of your total car expenses. You should keep a mileage log to calculate the business %. Pros: Potentially higher deductions if your car is expensive to run Can claim precise costs for tax efficiency Cons: Requires detailed record-keeping of all expenses More time-consuming Simplified Expenses: Flat Rates Made Easy HMRC’s simplified expenses allow you to claim a flat rate per mile, without tracking actual vehicle costs. The rates for 2025/26 are: 45p per mile for the first 10,000 business miles 25p per mile for additional business miles How it works: If you drive 8,000 business miles in the year, you simply multiply 8,000 by 45p, giving a claim of £3,600. Pros: Easy to calculate and track No receipts or detailed records required (just a mileage log) Cons: May be less beneficial if your actual vehicle expenses are high Which Method Should You Choose? Use actual costs if your vehicle is expensive to run and business use is significant. Use simplified expenses if you want a straightforward, low-maintenance approach. Many self-employed people track both methods during the year to compare and choose whichever gives a bigger tax deduction. Note that once you've made a choice, you need to carry on with that choice for the whole time you use that vehicle. Need help simplifying your taxes? If you’re self-employed and not sure what you can claim, we can make it clear. Get in touch with CJL Accountancy today, we’ll help you make sense of your numbers so you can focus on your business.

If you’re self-employed, you already have enough to think about without getting lost in piles of receipts and complex calculations. That’s where HMRC’s Simplified Expenses come in; a set of flat-rate allowances designed to make claiming certain business costs quicker and easier. But what exactly are simplified expenses, and are they the right choice for you? Let’s break it down. What are Simplified Expenses? Simplified expenses are flat rates set by HMRC that you can use instead of working out the exact cost of some common business expenses. They’re for sole traders and partnerships, not limited companies. You can use them for things like: Business use of your home Business mileage Living at your business premises (for example, if you run a guest house or bed and breakfast) Using the flat rates means you don’t need to record every exact bill or split personal and business costs manually; HMRC’s set figures do the work for you. Business Use of Your Home If you work from home, HMRC lets you claim a monthly flat rate based on the number of hours you work there each month: 25-50 hours worked - £10 claim 51-100 hours worked - £18 claim 101+ hours worked - £26 claim You can claim different amounts for each month if you work different hours each month, and it can include diary planning and doing your bookkeeping. This is instead of working out the exact costs and what proportion to claim. You can also still claim separate costs for things like phone and internet if used for business. Business Mileage (Cars, Vans, Motorcycles) Instead of tracking every cost for fuel, insurance, and servicing, you can use HMRC’s approved mileage rates: Cars and vans - 45p per mile for the first 10,000 miles, then 25p after Motorcycles - 24p per mile You just need to record your business miles, no receipts required for petrol or repairs. This is instead of working out the exact costs and claiming the business proportion. Note that once you've made a decision to claim mileage or actual costs, you must continue for that vehicle. Living at Your Business Premises If you live where you work - for example, you run a small B&B - you can use simplified expenses to adjust for personal use. You’ll calculate your actual business costs (such as utilities, council tax, etc.) and then subtract a fixed amount for your personal use, depending on how many people live there: 1 person - £350 per month 2 people - £500 per month 3 or more people - £650 per month Should You Use Simplified Expenses? Simplified expenses can make your bookkeeping much easier, but they’re not always the most tax-efficient option. ✅ They’re great if you want to: Save time on record-keeping Keep your accounts simple Have low or average running costs ⚠️ But they might not be right if: You have high actual expenses You want to claim the exact cost of bills or travel You need precise figures for business analysis or funding applications We recommend trying both methods for a short period; track your actual costs for a month or two, then compare them to the flat rates. You’ll quickly see which gives you the better result. If you’re unsure, we can review your figures and help you choose the most efficient option for your next tax return. Need help simplifying your taxes? If you’re self-employed and not sure what you can claim, we can make it clear. Get in touch with CJL Accountancy today , we’ll help you make sense of your numbers so you can focus on your business.

If you’re one of the millions of people who need to complete a Self Assessment tax return, the key date to remember is 31 January 2026 (for the 2024/25 tax year). That’s the deadline to file your return and pay any tax due to HMRC. At CJL Accountancy, we always encourage clients to submit their returns early where possible, but if you haven’t done it yet, there’s still time. Here’s what happens if you miss the deadline, and why acting quickly can save you money and stress. What happens if you miss the Self Assessment deadline? If your tax return isn’t submitted by midnight on 31 January , HMRC will automatically issue a £100 late filing penalty , even if you don’t owe any tax. After that, further penalties apply: 3 months late: £10 per day, up to a maximum of £900 6 months late: An additional £300 (or 5% of the tax due, if higher) 12 months late: Another £300 (or 5% of the tax due, if higher) These penalties can add up quickly, especially if you miss multiple deadlines. Late payment penalties HMRC also charge penalties for paying your tax late , whether your tax return is filed or not. These are: 5% of the tax unpaid after 30 days Another 5% after 6 months A final 5% after 12 months It's worth noting that you can make a tax payment even if you haven't filed your tax return , which can help reduce penalties. Interest charges on late tax payments HMRC will start charging interest from 1 February on any outstanding tax. The interest rate will be 7.75% from 9 January 2026 (it's 4% above the Bank of England base rate). Can you appeal? If you have a reasonable excuse - for example, serious illness or technical issues with HMRC’s system - you can appeal a late filing or late payment penalty. However, HMRC is strict about what counts as reasonable, so it’s best not to rely on this. If you’re appealing on technical issues, keep screenshots or videos of the errors you encounter. Interest charges, however, are very difficult to appeal because they’re designed to compensate HMRC for the late payment and reflect the benefit you had from holding onto the funds. Time-to-pay You can set up a time-to-pay arrangement with HMRC if you can't make the full tax payment on time. You can either do this in your online self-assessment account or by contacting HMRC. Penalties are suspended if you have a time-to-pay agreement, as long as you stick to the agreed terms. What should I do if I haven't filed my return yet? You still have some time; try to prepare and file your tax return and pay your tax by 31 January. If that's not possible: File a provisional return by 31 January: If you're waiting for information to finalise your tax return then file with the information you do have and perhaps an estimate of what you're waiting for. You have 12 months to file your final return. Make a payment on account: If you're not sure what your final tax figure is, make an estimated payment on account to reduce interest and penalties. How to avoid penalties and reduce stress File early: In the future, even if you wait to pay until January, filing early gives you time to plan your tax bill. Check your details: Make sure HMRC has your up-to-date address so you don’t miss important letters. Use professional support: An accountant can help you submit accurately and claim all allowable expenses. Plan for payment: Set aside funds throughout the year to avoid a cash flow shock in January. If you’re not sure where to start, CJL Accountancy can help you complete your return quickly and accurately so you can avoid penalties. Please note: We cannot guarantee meeting the 31 January filing deadline for clients signing up in January. However, we may be able to reduce interest and penalties by preparing your return soon after. For the 2025/26 tax year, we’ll work with you to get things completed early. Get in touch with CJL Accountancy today .

Running a business means wearing many hats and understanding your finances is one of the most important ones. But accounting terms can sometimes sound like a different language. To help, we’ve put together a simple guide to common accountancy terms you’ll see on reports, invoices, or from your accountant, explained in plain English. Assets Things your business owns that have value - for example, cash, stock, vehicles, or equipment. Assets are what help your business operate and generate income. Liabilities The opposite of assets - these are what your business owes to others. That includes loans, unpaid bills, or taxes due. Equity Equity is what’s left when you subtract your liabilities from your assets. It represents the owner’s share of the business, often referred to as “net assets.” Directors, Shareholders and Sole Traders In the UK, there are different ways to run a business, and each comes with its own responsibilities. A sole trader runs the business as an individual (referred to as being self-employed) - you keep all the profits after tax but are personally responsible for any debts. A shareholder owns part (or all) of a limited company. Profits can be paid to shareholders as dividends. A director manages the day-to-day running of a limited company. Many small business owners are both directors and shareholders, meaning they can take a salary and dividends as income. Understanding which structure applies to you helps ensure your accounts and taxes are handled correctly. Turnover (or Revenue) Your total sales or income before any expenses are taken off. It’s a key measure of how much your business is bringing in. Profit What’s left after all costs have been deducted from your turnover. Gross profit is your sales minus the direct costs of making or buying your products. Net profit is what’s left after all expenses, including overheads and tax. Expenses The costs of running your business, such as rent, insurance, travel, or subscriptions. Keeping track of expenses is essential for accurate accounts and tax returns. Cash Flow Cash flow shows how money moves in and out of your business. A positive cash flow means more money is coming in than going out which keeps things running smoothly. Accounts Payable Money your business owes to suppliers, often referred to as creditors. Accounts Receivable Money owed to your business by customers, sometimes called debtors. Balance Sheet A snapshot of your business’s financial position at a specific point in time (usually your accounting year end). It shows assets, liabilities, and equity all in one place. Profit and Loss Account (P&L) A report showing your business income and expenses over a period (usually your accounting year). It tells you if you made a profit or a loss. VAT (Value Added Tax) A tax added to most goods and services. If your business is VAT-registered, you’ll need to charge VAT on sales and submit returns to HMRC. You'll need to register for VAT if your taxable turnover exceeds the threshold, there's more information on this here . Corporation Tax If you run a limited company, you’ll pay Corporation Tax on your company’s profits each year. Dividends Dividends are payments made by a limited company to its shareholders from profits after Corporation Tax. They’re a common way for director/shareholders to take income, alongside a salary. Dividends must be supported by enough profit in the company, and each payment should be documented with a dividend voucher and board minute. Self-Assessment If you’re self-employed or receive other untaxed income, you’ll need to file a Self Assessment tax return to HMRC to calculate and pay your Income Tax and National Insurance. Need help making sense of your accounts? At CJL Accountancy, we believe finance doesn’t have to be complicated. We explain things clearly, help you understand your numbers, and make sure you’re compliant with HMRC - without the jargon. 📞 Get in touch to find out how we can make your accounts simple and stress-free.

Tax can be complicated - and with so many recent changes announced in the Autumn Budget, it’s never been more important to understand how to manage your tax affairs the right way. At CJL Accountancy, we often hear business owners and individuals use the terms tax evasion, tax avoidance and tax planning interchangeably. But there are some big and crucial differences between them. Let’s break down what each one really means. Tax Evasion - Illegal and Punishable Tax evasion is when someone deliberately hides income or falsifies information to reduce their tax bill. Examples include: Not declaring all business income Paying workers cash “off the books” Claiming personal expenses as business costs Tax evasion is illegal and can lead to severe consequences such as fines, penalties, and even prosecution. HMRC has sophisticated systems in place to detect irregularities, so it’s never worth the risk. Tax Avoidance - Legal but Risky Tax avoidance involves using loopholes or complex arrangements to reduce tax bills in ways that may not align with the spirit of the law. It’s technically legal, but HMRC regularly challenges aggressive avoidance schemes. For example: Setting up artificial company structures solely to pay less tax Using offshore schemes or trusts with no real business purpose These strategies can backfire, resulting in large, backdated tax bills, penalties, and reputational damage. Tax Planning - Legal, Sensible and Essential Tax planning, on the other hand, is both legal and encouraged. It’s about making smart financial decisions to manage your tax efficiently, within the rules. This might include: Making use of allowances and reliefs (e.g. ISA limits, pension contributions, capital allowances) Structuring your business in the most tax-efficient way Timing income or expenses to maximise reliefs With changes announced in the Autumn Budget, effective tax planning has become even more important. Whether that’s adjusting salary and dividend mixes, reviewing capital allowance claims, or preparing for new thresholds, planning ahead can help you stay compliant while minimising unnecessary tax. Why Work With a Qualified Accountant A qualified accountant can help you: ✅ Stay compliant with HMRC rules ✅ Identify opportunities for legitimate savings ✅ Plan ahead for future tax changes At CJL Accountancy, we help clients make confident, informed decisions - balancing compliance with smart planning.