Landlord’s Guide to Tax

Chrissy Leach • 8 September 2024

An overview of what you need to know about tax as a UK property owner

The tax landscape for landlords is complex and understanding your tax obligations is crucial for staying compliant and optimising your financial position. This guide will walk you through the key tax considerations for landlords in the UK.

Income Tax on Rental Income

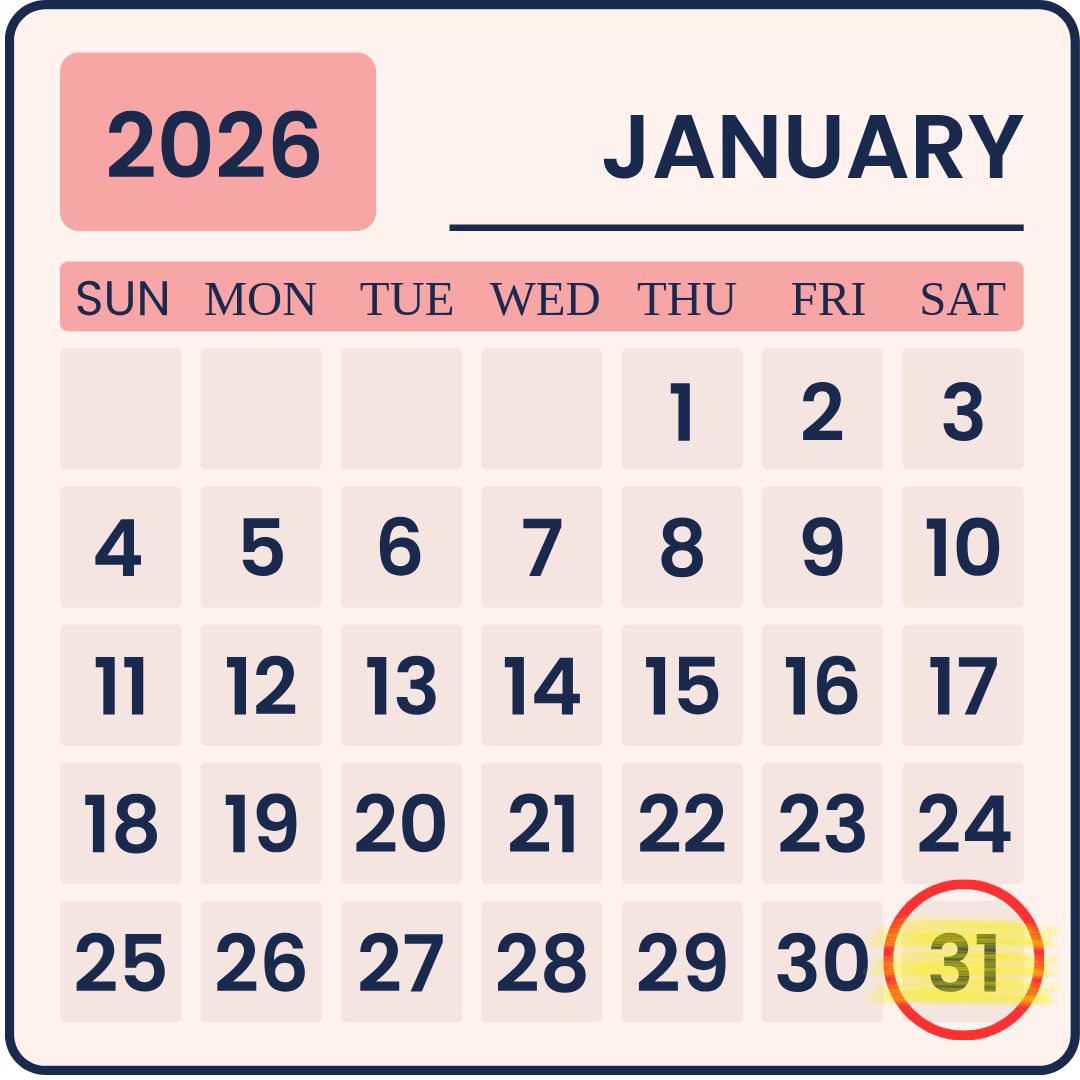

As a landlord, you are required to pay income tax on the profit you make from renting out your property. Your rental income must be declared on a self-assessment tax return for the tax year (6 April to the next 5 April) and this needs to be filed by the next 31 January. The profit is calculated as your total rental income minus allowable expenses. Any tax liability must be paid by the tax return filing deadline and you may also need to pay payments on account for the next tax year on 31 January and 31 July.

Allowable Expenses

Allowable expenses are costs that you can deduct from your rental income to reduce your tax bill. These include:

- Letting agent fees and management fees

- Property repairs and maintenance (but not improvements)

- Ground rent and service charges

- Council tax, insurance, and utility bills (if paid by the landlord)

- Accountancy fees for preparing rental accounts

If costs are below £1,000 then the property allowance can be claimed in place of actual expenses.

Mortgage Payments

Only the interest element of mortgage payments can be claimed, not the capital repayment. If you have an interest only mortgage then this will be the whole payment.

The mortgage interest is not allowable as a deduction from your rental income but a basic rate tax relief can be claimed. This means the tax relief is restricted for higher or additional rate taxpayers.

Capital Gains Tax (CGT) on Property Sales

If you decide to sell a rental property, you may be liable to pay CGT on the profit (gain) you make from the sale. CGT is payable on the difference between the sale price and the original purchase price, minus allowable costs such as:

- Solicitor and estate agent fees

- Costs of improvement works (but not routine repairs)

- Stamp Duty Land Tax (SDLT) paid on purchase

The CGT rates for residential property at the time of writing are:

- 18% for gain in the basic tax rate

- 24% for gain in the higher or additional tax rates

Every individual has an annual CGT allowance (£3,000 for 2024/25), which can be deducted from your total gains before calculating the tax.

If the property was at any time your main residence, you may be eligible for Private Residence Relief (PRR), which can reduce the taxable gain.

A CGT return may need to be filed within 60 days of completion when a UK residential property is sold, and any CGT paid by the same date. Penalties will be charged for late filing and payment.

Making Tax Digital (MTD)

The UK government’s Making Tax Digital (MTD) initiative will require some taxpayers, including landlords, to maintain digital records and submit tax returns electronically. Landlords with gross income above £50,000 must comply with MTD for Income Tax from April 2026, and those with gross income above £30,000 from April 2027. See our previous post for more about this.

Properties Held In Companies

You may wish to build your property portfolio in a limited company which can be especially useful if you are a higher/additional rate taxpayer and do not need to access the profits immediately.

You should be aware of the following:

- If you already own the property(s) then there can be tax payable on transfer into a limited company.

- If any property is valued over the Annual Tax on Enveloped Dwellings (ATED) threshold then you’ll need to file an ATED return each year and may have additional tax to pay. The threshold is £500k at the time of writing.

- The mortgage interest restriction is not relevant for properties held in companies.

- The company will pay corporation tax on profits.

Conclusion

Navigating the UK’s property tax landscape as a landlord can be challenging, but understanding the key tax rules and planning ahead can make a significant difference. Whether it’s optimising allowable expenses, planning for CGT, or preparing for MTD, staying informed and seeking professional advice is essential for minimising your tax burden and maximising your rental income.

If you’re self-employed and use a car for business purposes, knowing how to claim your vehicle costs correctly can save you both time and money. HMRC offers two methods for claiming car expenses: actual costs and simplified expenses. Choosing the right method depends on your circumstances and record-keeping preferences. What is Business Mileage? Business mileage refers to your journeys for work-related activities that are not your normal commute. This includes: Visiting clients or suppliers Traveling between work sites Collecting or delivering goods Attending business meetings or events Commuting from home to your usual workplace does not count as business mileage. Keeping an accurate mileage log is essential for claiming either actual costs or simplified expenses. Actual Costs: Claim What You Really Spend Claiming actual costs means calculating your business-related vehicle expenses based on your receipts and records. Eligible costs include: Fuel Insurance Road tax MOTs Repairs and servicing Vehicle cost (subject to capital allowance rules) How it works: You need to calculate the percentage of business use. For example, if your car is used 60% for business, you can claim 60% of your total car expenses. You should keep a mileage log to calculate the business %. Pros: Potentially higher deductions if your car is expensive to run Can claim precise costs for tax efficiency Cons: Requires detailed record-keeping of all expenses More time-consuming Simplified Expenses: Flat Rates Made Easy HMRC’s simplified expenses allow you to claim a flat rate per mile, without tracking actual vehicle costs. The rates for 2025/26 are: 45p per mile for the first 10,000 business miles 25p per mile for additional business miles How it works: If you drive 8,000 business miles in the year, you simply multiply 8,000 by 45p, giving a claim of £3,600. Pros: Easy to calculate and track No receipts or detailed records required (just a mileage log) Cons: May be less beneficial if your actual vehicle expenses are high Which Method Should You Choose? Use actual costs if your vehicle is expensive to run and business use is significant. Use simplified expenses if you want a straightforward, low-maintenance approach. Many self-employed people track both methods during the year to compare and choose whichever gives a bigger tax deduction. Note that once you've made a choice, you need to carry on with that choice for the whole time you use that vehicle. Need help simplifying your taxes? If you’re self-employed and not sure what you can claim, we can make it clear. Get in touch with CJL Accountancy today, we’ll help you make sense of your numbers so you can focus on your business.

If you’re self-employed, you already have enough to think about without getting lost in piles of receipts and complex calculations. That’s where HMRC’s Simplified Expenses come in; a set of flat-rate allowances designed to make claiming certain business costs quicker and easier. But what exactly are simplified expenses, and are they the right choice for you? Let’s break it down. What are Simplified Expenses? Simplified expenses are flat rates set by HMRC that you can use instead of working out the exact cost of some common business expenses. They’re for sole traders and partnerships, not limited companies. You can use them for things like: Business use of your home Business mileage Living at your business premises (for example, if you run a guest house or bed and breakfast) Using the flat rates means you don’t need to record every exact bill or split personal and business costs manually; HMRC’s set figures do the work for you. Business Use of Your Home If you work from home, HMRC lets you claim a monthly flat rate based on the number of hours you work there each month: 25-50 hours worked - £10 claim 51-100 hours worked - £18 claim 101+ hours worked - £26 claim You can claim different amounts for each month if you work different hours each month, and it can include diary planning and doing your bookkeeping. This is instead of working out the exact costs and what proportion to claim. You can also still claim separate costs for things like phone and internet if used for business. Business Mileage (Cars, Vans, Motorcycles) Instead of tracking every cost for fuel, insurance, and servicing, you can use HMRC’s approved mileage rates: Cars and vans - 45p per mile for the first 10,000 miles, then 25p after Motorcycles - 24p per mile You just need to record your business miles, no receipts required for petrol or repairs. This is instead of working out the exact costs and claiming the business proportion. Note that once you've made a decision to claim mileage or actual costs, you must continue for that vehicle. Living at Your Business Premises If you live where you work - for example, you run a small B&B - you can use simplified expenses to adjust for personal use. You’ll calculate your actual business costs (such as utilities, council tax, etc.) and then subtract a fixed amount for your personal use, depending on how many people live there: 1 person - £350 per month 2 people - £500 per month 3 or more people - £650 per month Should You Use Simplified Expenses? Simplified expenses can make your bookkeeping much easier, but they’re not always the most tax-efficient option. ✅ They’re great if you want to: Save time on record-keeping Keep your accounts simple Have low or average running costs ⚠️ But they might not be right if: You have high actual expenses You want to claim the exact cost of bills or travel You need precise figures for business analysis or funding applications We recommend trying both methods for a short period; track your actual costs for a month or two, then compare them to the flat rates. You’ll quickly see which gives you the better result. If you’re unsure, we can review your figures and help you choose the most efficient option for your next tax return. Need help simplifying your taxes? If you’re self-employed and not sure what you can claim, we can make it clear. Get in touch with CJL Accountancy today , we’ll help you make sense of your numbers so you can focus on your business.

If you’re one of the millions of people who need to complete a Self Assessment tax return, the key date to remember is 31 January 2026 (for the 2024/25 tax year). That’s the deadline to file your return and pay any tax due to HMRC. At CJL Accountancy, we always encourage clients to submit their returns early where possible, but if you haven’t done it yet, there’s still time. Here’s what happens if you miss the deadline, and why acting quickly can save you money and stress. What happens if you miss the Self Assessment deadline? If your tax return isn’t submitted by midnight on 31 January , HMRC will automatically issue a £100 late filing penalty , even if you don’t owe any tax. After that, further penalties apply: 3 months late: £10 per day, up to a maximum of £900 6 months late: An additional £300 (or 5% of the tax due, if higher) 12 months late: Another £300 (or 5% of the tax due, if higher) These penalties can add up quickly, especially if you miss multiple deadlines. Late payment penalties HMRC also charge penalties for paying your tax late , whether your tax return is filed or not. These are: 5% of the tax unpaid after 30 days Another 5% after 6 months A final 5% after 12 months It's worth noting that you can make a tax payment even if you haven't filed your tax return , which can help reduce penalties. Interest charges on late tax payments HMRC will start charging interest from 1 February on any outstanding tax. The interest rate will be 7.75% from 9 January 2026 (it's 4% above the Bank of England base rate). Can you appeal? If you have a reasonable excuse - for example, serious illness or technical issues with HMRC’s system - you can appeal a late filing or late payment penalty. However, HMRC is strict about what counts as reasonable, so it’s best not to rely on this. If you’re appealing on technical issues, keep screenshots or videos of the errors you encounter. Interest charges, however, are very difficult to appeal because they’re designed to compensate HMRC for the late payment and reflect the benefit you had from holding onto the funds. Time-to-pay You can set up a time-to-pay arrangement with HMRC if you can't make the full tax payment on time. You can either do this in your online self-assessment account or by contacting HMRC. Penalties are suspended if you have a time-to-pay agreement, as long as you stick to the agreed terms. What should I do if I haven't filed my return yet? You still have some time; try to prepare and file your tax return and pay your tax by 31 January. If that's not possible: File a provisional return by 31 January: If you're waiting for information to finalise your tax return then file with the information you do have and perhaps an estimate of what you're waiting for. You have 12 months to file your final return. Make a payment on account: If you're not sure what your final tax figure is, make an estimated payment on account to reduce interest and penalties. How to avoid penalties and reduce stress File early: In the future, even if you wait to pay until January, filing early gives you time to plan your tax bill. Check your details: Make sure HMRC has your up-to-date address so you don’t miss important letters. Use professional support: An accountant can help you submit accurately and claim all allowable expenses. Plan for payment: Set aside funds throughout the year to avoid a cash flow shock in January. If you’re not sure where to start, CJL Accountancy can help you complete your return quickly and accurately so you can avoid penalties. Please note: We cannot guarantee meeting the 31 January filing deadline for clients signing up in January. However, we may be able to reduce interest and penalties by preparing your return soon after. For the 2025/26 tax year, we’ll work with you to get things completed early. Get in touch with CJL Accountancy today .

Running a business means wearing many hats and understanding your finances is one of the most important ones. But accounting terms can sometimes sound like a different language. To help, we’ve put together a simple guide to common accountancy terms you’ll see on reports, invoices, or from your accountant, explained in plain English. Assets Things your business owns that have value - for example, cash, stock, vehicles, or equipment. Assets are what help your business operate and generate income. Liabilities The opposite of assets - these are what your business owes to others. That includes loans, unpaid bills, or taxes due. Equity Equity is what’s left when you subtract your liabilities from your assets. It represents the owner’s share of the business, often referred to as “net assets.” Directors, Shareholders and Sole Traders In the UK, there are different ways to run a business, and each comes with its own responsibilities. A sole trader runs the business as an individual (referred to as being self-employed) - you keep all the profits after tax but are personally responsible for any debts. A shareholder owns part (or all) of a limited company. Profits can be paid to shareholders as dividends. A director manages the day-to-day running of a limited company. Many small business owners are both directors and shareholders, meaning they can take a salary and dividends as income. Understanding which structure applies to you helps ensure your accounts and taxes are handled correctly. Turnover (or Revenue) Your total sales or income before any expenses are taken off. It’s a key measure of how much your business is bringing in. Profit What’s left after all costs have been deducted from your turnover. Gross profit is your sales minus the direct costs of making or buying your products. Net profit is what’s left after all expenses, including overheads and tax. Expenses The costs of running your business, such as rent, insurance, travel, or subscriptions. Keeping track of expenses is essential for accurate accounts and tax returns. Cash Flow Cash flow shows how money moves in and out of your business. A positive cash flow means more money is coming in than going out which keeps things running smoothly. Accounts Payable Money your business owes to suppliers, often referred to as creditors. Accounts Receivable Money owed to your business by customers, sometimes called debtors. Balance Sheet A snapshot of your business’s financial position at a specific point in time (usually your accounting year end). It shows assets, liabilities, and equity all in one place. Profit and Loss Account (P&L) A report showing your business income and expenses over a period (usually your accounting year). It tells you if you made a profit or a loss. VAT (Value Added Tax) A tax added to most goods and services. If your business is VAT-registered, you’ll need to charge VAT on sales and submit returns to HMRC. You'll need to register for VAT if your taxable turnover exceeds the threshold, there's more information on this here . Corporation Tax If you run a limited company, you’ll pay Corporation Tax on your company’s profits each year. Dividends Dividends are payments made by a limited company to its shareholders from profits after Corporation Tax. They’re a common way for director/shareholders to take income, alongside a salary. Dividends must be supported by enough profit in the company, and each payment should be documented with a dividend voucher and board minute. Self-Assessment If you’re self-employed or receive other untaxed income, you’ll need to file a Self Assessment tax return to HMRC to calculate and pay your Income Tax and National Insurance. Need help making sense of your accounts? At CJL Accountancy, we believe finance doesn’t have to be complicated. We explain things clearly, help you understand your numbers, and make sure you’re compliant with HMRC - without the jargon. 📞 Get in touch to find out how we can make your accounts simple and stress-free.

Tax can be complicated - and with so many recent changes announced in the Autumn Budget, it’s never been more important to understand how to manage your tax affairs the right way. At CJL Accountancy, we often hear business owners and individuals use the terms tax evasion, tax avoidance and tax planning interchangeably. But there are some big and crucial differences between them. Let’s break down what each one really means. Tax Evasion - Illegal and Punishable Tax evasion is when someone deliberately hides income or falsifies information to reduce their tax bill. Examples include: Not declaring all business income Paying workers cash “off the books” Claiming personal expenses as business costs Tax evasion is illegal and can lead to severe consequences such as fines, penalties, and even prosecution. HMRC has sophisticated systems in place to detect irregularities, so it’s never worth the risk. Tax Avoidance - Legal but Risky Tax avoidance involves using loopholes or complex arrangements to reduce tax bills in ways that may not align with the spirit of the law. It’s technically legal, but HMRC regularly challenges aggressive avoidance schemes. For example: Setting up artificial company structures solely to pay less tax Using offshore schemes or trusts with no real business purpose These strategies can backfire, resulting in large, backdated tax bills, penalties, and reputational damage. Tax Planning - Legal, Sensible and Essential Tax planning, on the other hand, is both legal and encouraged. It’s about making smart financial decisions to manage your tax efficiently, within the rules. This might include: Making use of allowances and reliefs (e.g. ISA limits, pension contributions, capital allowances) Structuring your business in the most tax-efficient way Timing income or expenses to maximise reliefs With changes announced in the Autumn Budget, effective tax planning has become even more important. Whether that’s adjusting salary and dividend mixes, reviewing capital allowance claims, or preparing for new thresholds, planning ahead can help you stay compliant while minimising unnecessary tax. Why Work With a Qualified Accountant A qualified accountant can help you: ✅ Stay compliant with HMRC rules ✅ Identify opportunities for legitimate savings ✅ Plan ahead for future tax changes At CJL Accountancy, we help clients make confident, informed decisions - balancing compliance with smart planning.

At CJL Accountancy, we’ve summarised the key announcements that could impact your personal or business finances - and what you can do to prepare. 1. Income Tax Thresholds Frozen Until 2031 The personal allowance (£12,570), basic rate threshold (£37,700), and higher rate threshold (£87,440) were already frozen until March 2028 - and this freeze has now been extended to March 2031. This is effectively a stealth tax: as wages rise, more income falls into higher tax brackets. Important note: Tax is only charged at the higher rate on the portion of income that falls above each threshold, not on your total income. So, if your earnings move into the higher rate band, only the amount above £50,270 is taxed at 40%, not everything you earn. 2. £2,000 Cap on Salary Sacrifice from 2029 From April 2029, the tax-efficient salary sacrifice scheme for pension contributions will be capped at £2,000 per year. There’s no indication that employer pension contributions from your own limited company will be affected - these can continue as usual. 3. Rental Property Tax Increased by 2% From April 2027, tax on rental profits will rise by two percentage points: Basic rate: 22% Higher rate: 42% Additional rate: 47% It’s important to claim all allowable expenses to reduce taxable profits - for example, agent fees, insurance, repairs, and mortgage interest. Tip: If you’re considering selling an investment property, speak to us first to plan for any potential Capital Gains Tax (CGT) implications. 4. Savings Income Tax Increased by 2% From April 2027, tax on savings income (such as bank interest) will also increase by two percentage points: Basic rate: 22% Higher rate: 42% Additional rate: 47% The personal savings allowance remains unchanged: £1,000 for basic rate taxpayers £500 for higher rate taxpayers No allowance for additional rate taxpayers Tip: Consider moving savings into ISAs, where interest and growth are tax-free. 5. Cash ISA Limit Reduced for Under-65s The ISA allowance remains at £20,000 per year, frozen until March 2031. However, from April 2027, those aged under 65 will be limited to £12,000 in Cash ISAs, with the remainder needing to be invested in Stocks & Shares ISAs. Note: Investments can go down as well as up, and past performance is not a guarantee of future results. We don’t provide investment advice, but we can connect you with a trusted financial advisor. 6. Dividend Tax Rates Increased by 2% From April 2026, dividend tax rates will rise by two percentage points: Basic rate: 10.75% Higher rate: 35.75% Additional rate: 39.35% (unchanged) Tip: Company directors may wish to consider bringing forward dividend payments before April 2026 to benefit from current rates. 7. EIS and VCT Changes From April 2026, the government will increase investment limits for the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs) to encourage more funding for startups and small businesses. However, the income tax relief for VCTs will reduce from 30% to 20%. The rules for businesses applying for EIS are also changing to allow scale-ups to benefit as well as start-ups. 8. Capital Gains Tax for Employee Ownership Trusts (EOTs) With immediate effect, CGT relief on sales of businesses into Employee Ownership Trusts will reduce. From 26 November 2025, 50% of the gain on disposal to the trustees of an Employee Ownership Trust will be treated as the disposer’s chargeable gain for CGT purposes. The remaining 50% of the gain will not be chargeable at the time of disposal but will continue to be held over to come into charge on any future disposal of the shares by the trustees of the Employee Ownership Trust. 9. Capital Allowances Changes From April 2026, writing down allowances for plant and machinery will reduce from 18% to 14%. Businesses can still claim 100% Annual Investment Allowance (AIA) on qualifying assets in the year of purchase up to the £1m threshold. If you have a large purchase to make, the timing should be planned. 10. Making Tax Digital (MTD) MTD is still going ahead - but there’s good news. HMRC has confirmed that there will be no late submission penalties for quarterly updates during the 2026/27 tax year. Tip: If you’re self-employed or a landlord, now’s the time to review your bookkeeping systems to ensure you’re ready for digital reporting. Other Budget Measures Mansion Tax: Introduced on properties worth over £2 million from April 2028 Business Rates: New reliefs for small businesses, retail, hospitality and leisure sectors from April 2026 National Minimum Wage: Increased from April 2026 Apprenticeships: Fully funded apprenticeships for SMEs Warm Homes Plan: Additional funding for energy efficiency and heating schemes Fuel Duty: Frozen until at least September 2026 Electric Vehicles: A per-mile charge will be introduced for EVs and hybrids Universal Credit: The two-child limit will be removed from April 2026 Next Steps If any of these changes may affect you, CJL Accountancy can help you plan ahead. We can review your personal or business tax position, model the potential impact of upcoming rate changes, and help you make the most of available reliefs and allowances. 📩 Get in touch today to arrange a chat - we’ll make sure you’re in the best possible position ahead of the new tax years.

As the Autumn Budget 2025 approaches on Wednesday 26 November, all eyes are on Chancellor Rachel Reeves and her first major fiscal statement since Labour took office. The Budget comes against a backdrop of a flatlining economy, high borrowing costs and calls for both fairness and fiscal discipline. The Chancellor has promised a “responsible” approach, but one that could still involve difficult decisions. The Economic Context The UK economy continues to face sluggish growth, rising debt interest payments and pressure on public services. The Office for Budget Responsibility (OBR) is expected to publish cautious growth forecasts, leaving limited scope for giveaways. The Treasury has already warned that while the economy “isn’t broken”, it “isn’t working well enough for working people”. That sets the tone for a Budget focused on long-term productivity and fair taxation. What’s Already Been Signalled In her pre-Budget speech last week, Rachel Reeves set expectations by reaffirming her commitment to fiscal responsibility - and notably did not rule out tax increases. However, Labour’s manifesto promised not to raise the headline rates of Income Tax, VAT or National Insurance for working people. That means any revenue-raising measures are likely to come from less visible adjustments - such as frozen thresholds, relief changes or targeted reforms. Key Rumours Ahead of 26 November Here’s what’s being speculated by analysts and the financial press: Income Tax The tax thresholds are currently frozen until 2028 - a “stealth tax” increase because more tax is payable when pay rises are received (even if they don’t even keep up with inflation). This could be extended beyond 2028, as it generates around £8bn annually. Income Tax v National Insurance There are rumours of a 2% rise on income tax with an equal 2% reduction in national insurance. Whilst this will have a neutral effect for working people, pensioners and landlords do not pay national insurance and would be impacted by the 2% rise. National Insurance on Rental Income There are rumours that national insurance could start to be charged on rental profits, meaning that landlords could see a significant cut to their post-tax profits. Pensions and Salary Sacrifice The rumoured changes to the 25% tax-free pension withdrawal are no longer on the table, but salary-sacrifice could be changed. Salary-sacrifice is when employees sacrifice a portion of their salary for pension contributions which save both tax and national insurance for the employees, and also employers national insurance for the employers. There’s speculation that national insurance relief on salary-sacrifice pension contributions could be capped (for example, only applying to the first £2,000). ISA Allowances Reports suggest possible tweaks to the annual ISA limit, particularly the Cash ISA limit, which is said to be aimed at encouraging investing rather than providing tax revenue. Corporation Tax The main rate is expected to stay at 25%, but businesses could see a tightening of certain reliefs or investment allowances. Property and Capital Taxes Adjustments to Stamp Duty or Capital Gains Tax on property are being discussed as potential revenue-raisers. “Modern” Taxes Environmental and digital-focused levies could appear, aligning with Labour’s sustainability agenda. What It Could Mean for Businesses and Individuals Income Planning Frozen or lowered thresholds could mean more tax on the same income. Reviewing dividend strategies, bonuses or salary levels will be worthwhile for owner managed businesses. Payroll & Pension Structures If salary-sacrifice changes are introduced, employers and directors using these arrangements should review the impact on take-home pay. Business Reliefs Any change to R&D, capital allowances or small-business reliefs could affect year-end planning, particularly for growing companies. Personal Savings ISAs and pensions remain essential tax-efficient vehicles, so maximising allowances is sensible. What Happens Next The Budget will be delivered on Wednesday 26 November. Our blog the next week will cover the changes; often the devil is in the detail. As always, the above are rumours, so we wouldn’t advise making any drastic changes before then, particularly as we don’t know whether changes would be immediate or at the start of the next tax year. It’s important to speak to your accountant about any changes that might affect you once the Budget is delivered. They can help you work through your options. Key Takeaway The Autumn Budget 2025 is expected to focus on stability, credibility and gradual fiscal tightening - rather than major rate hikes. But “fiscal drag” through frozen thresholds, and subtle changes to reliefs, could still raise billions in additional revenue. Tax planning remains crucial for both businesses and individuals.

What Is a Company Year-End? Your company year-end marks the end of your accounting period. It's usually 12 months after the date you registered your company with Companies House, but you can change it to align with the calendar year, tax year, or your seasonality, whenever you want. This date determines: When your annual accounts are due to Companies House When your Corporation Tax return (CT600) is due to HMRC The period covered by your company’s financial statements What Happens at Year-End? At the end of your accounting period, you’ll need to prepare your statutory accounts - a formal set of financial statements that summarise your business performance for the year. These include: Profit and loss account – showing income, expenses, and profit Balance sheet – showing your company’s assets, liabilities, and equity Notes to the accounts – giving context to your figures These figures are then used to prepare your Corporation Tax return and calculate how much tax your company owes. Pre-Year-End Accounting Checks Getting organised before your company year-end can make the whole process smoother and ensure you’re claiming all the reliefs you’re entitled to. Here are some key pre-year-end checks you should consider: 1. Review business income and invoices Check you've raised all sales invoices for work done Review your debtors list - chase any outstanding debts from customers and write off any bad debts 2. Record all expenses Check all business expenses are included Include any business expenses you've personally paid 3. Mileage and business travel Don't forget business mileage and travel not yet claimed 4. Employee costs Check that payroll is up to date Include any bonuses or benefits paid in the year 5. Director's remuneration Review your salary and dividend payments - are you optimising your pay strategy? Speak to your accountant if you're unsure how best to balance this 6. Director's loan account Do you owe your company money? There are tax implications of this if it's over £10k, or if it's not repaid within 9 months of the year-end Speak to your accountant about a repayment strategy 7. Stocktake If you hold stock, complete a stock count as close to year-end as possible 8. Asset and equipment purchases Have you bought any new equipment or assets that might qualify for capital allowances? If you need to invest in business equipment (like computers or machinery), doing so before your year-end could reduce your Corporation Tax bill through capital allowances. 9. Pensions and investments Have you made any pension contributions through the company? 10. Other considerations Have there been any changes in ownership, share structure or directors? Any large transactions or one-offs? Are you considering large purchases or investments? Are you planning for growth, investment or exit? Do you have surplus cash? Speak to your accountant about these points so they can work with you towards your goals. After Year-End: What Needs Filing Once your year-end has passed, your accountant will prepare and file the following: Company accounts These are for your information as they show the company performance during the year and balances at the end of the year. They are also sent to HMRC with the corporation tax return, and are filed with Companies House (a filleted version if your company is small) within 9 months of the year-end. Corporation tax return This calculates the corporation tax due and is sent to HMRC, with a copy of the accounts within 12 months of the year end. The corporation tax payment is due 9 months and 1 day after the year-end (yes, before the tax return needs to be filed). Common Mistakes to Avoid Leaving bookkeeping until after year-end (this can delay your accounts and tax return) Missing allowable expenses that reduce taxable profits Forgetting to claim reliefs like AIA (Annual Investment Allowance) Letting your director’s loan account go overdrawn without planning repayment How an Accountant Can Help An experienced accountant can do more than just file your accounts - they can help you plan ahead, stay compliant, and make informed financial decisions. At CJL Accountancy, we work with limited company owners to: Complete pre-year-end reviews to maximise tax efficiency Prepare compliant statutory accounts and corporation tax returns Submit filings on time to Companies House and HMRC Advise on dividends, expenses, and salary planning Final Thoughts Your limited company year-end isn’t just about compliance - it’s an opportunity to take stock of your business, review performance, and plan for the future. With the right preparation and professional support, it can be a straightforward and valuable part of running your business. Need help with your year-end accounts? CJL Accountancy can take care of everything from pre-year-end checks to filing your accounts and corporation tax return. 👉 Get in touch today to make your next year-end stress-free.

Whether you’re a sole trader taking on your first employee or a limited company director paying yourself and your team, in this guide we’ll walk through everything you need to know about UK payroll, including what it is, how to set it up, and what to do each month to stay compliant with HMRC. What is Payroll? Payroll is how you calculate, record, and pay your employees’ wages - including tax, National Insurance (NI), and pension contributions. You also use payroll to report this information to HMRC under the PAYE (Pay As You Earn) system. Do the Self-Employed Need Payroll? If you’re self-employed or a sole trader, you don’t need to set up a payroll system for yourself, you simply take profits from the business. However, you do need to set up payroll if you hire employees or apprentices. What About For A Limited Company If you run a limited company, you’ll likely need a PAYE payroll scheme, even if you’re the only person on it. It means you can pay yourself tax efficiently, with a mix of salary and dividends. An accountant can help you determine the optimal director’s salary and dividend mix for your business. Setting Up Payroll Step 1: Register as an Employer with HMRC Before paying anyone, you must register as an employer with HMRC. You’ll receive a PAYE reference and Accounts Office reference, which are needed for all payroll submissions. Step 2: Choose Payroll Software You’ll need software that can: Calculate PAYE and National Insurance, Generate payslips, Submit RTI (Real Time Information) reports to HMRC, and Produce year-end documents like P60s. Popular payroll software options include HMRC Basic PAYE Tools, Xero, and BrightPay. Step 3: Add Employees and Set Up Payment Details Enter details such as each employee’s name, address, date of birth, NI number, and tax code. For directors, you can choose between annual or monthly NI calculations depending on your pay frequency. Step 4: Run Payroll and Report to HMRC Each pay period (usually monthly): Calculate gross pay. Deduct tax, NI, and pension contributions. Generate payslips for each employee. Submit an FPS (Full Payment Submission) to HMRC on or before the pay date. Step 5: Pay HMRC You’ll need to pay HMRC any PAYE and NI due, usually by the 22nd of the following month (or the 19th if paying by post). You can pay quarterly if you have less than £1,500 per month to pay to HMRC. Don't Forget Pensions If you have employees, you'll need to assess them for auto-enrolment. If they meet the criteria to auto-enrol or opt in then you'll need to process that through the payroll and you may need to make contributions as an employer. Common Payroll Mistakes to Avoid Missing RTI deadlines - HMRC can issue penalties if submissions are late. Using the wrong tax code - Always update when HMRC send new tax codes. Forgetting pension auto-enrolment duties - You must assess and enrol eligible employees, even if you only have one. Not keeping records - Payroll records must be kept for at least three years. Can an Accountant Run Payroll for You? Absolutely! Many business owners choose to outsource payroll to save time and ensure compliance. At CJL Accountancy, we handle payroll for self-employed businesses and limited companies of all sizes, so you can focus on running your business while we keep everything compliant and on time. Final Thoughts Setting up and running payroll doesn’t have to be stressful. Once your system is in place, it’s simply a routine process of paying people accurately and reporting on time. 💡 Need help setting up payroll? We’ll register your PAYE scheme, run your monthly payroll, and deal with HMRC, so you don’t have to. 📩 Get in touch today to simplify your payroll with CJL Accountancy.

🎉 Christmas Parties: What You Can Claim Limited Companies HMRC allows a staff event to be treated as an allowable expense if it meets all three of these conditions: It’s an annual event – such as a Christmas party or summer BBQ. It’s open to all employees – not just directors or selected staff. It costs £150 or less per head (including VAT) – this includes food, drink, entertainment, transport, and accommodation. ✅ If all three apply, there’s no tax or National Insurance for the company or employees. ❌ If you go over £150, the whole amount (not just the excess) becomes taxable as a benefit in kind. You can invite guests to your Christmas party, but be careful not to invite clients, suppliers or referrers as it may end up as disallowable entertaining. It’s probably best for the invitees to be your employees and a plus one. 💡 Tip: You can have more than one annual event (e.g. summer BBQ and Christmas party) - just make sure the combined total per head stays within £150. Self-Employed (Sole Traders) Unfortunately, the £150 staff party exemption doesn’t apply to sole traders or partners if you’re the only person in the business. HMRC doesn’t consider entertaining yourself a business expense. However, if you employ staff, you can claim the cost of a staff Christmas event on the same £150 per head basis. 🎁 Christmas Gifts: What You Can and Can’t Give Client Gifts You can only deduct the cost of client gifts if all of the following apply: The total cost is £50 or less per client per year The gift promotes your business (e.g. branded notebooks, mugs, or calendars) It’s not food, drink, or tobacco (unless it’s a promotional sample) If any of those conditions aren’t met, the cost isn’t allowable for tax. Employee Gifts If you want to give your team something extra this Christmas, you can make use of the trivial benefits rule. You can give employees (including directors) a non-cash gift if: It costs £50 or less (including VAT) It’s not cash or a cash voucher It’s not a reward for work or performance It’s not part of their contract ✅ Examples: A Christmas hamper, gift card (non-cash), or bottle of wine. ❌ Not allowed: A £50 bonus paid through payroll, or a reward for hitting sales targets. For directors of close companies (typically where there are five or fewer shareholders), there’s a £300 annual cap on trivial benefits in total per director. Don’t Forget VAT If your business is VAT-registered, you can usually reclaim VAT on the cost of staff parties and gifts, as long as they’re for employees only and not for clients or family members. VAT on entertaining non-employees (including partners, clients, or spouses) cannot be reclaimed. Final Thoughts The Christmas season is a great opportunity to celebrate your team’s hard work, and it doesn’t have to come with an unwelcome tax bill. With a bit of planning, you can stay within HMRC’s exemptions and make the most of your festive budget. If you’re unsure whether your party or gifts qualify, CJL Accountancy can help you review your plans and make sure you’re claiming everything correctly. 👉 Get in touch before the year-end so we can help you make the most of your Christmas spend!